BTC Price Prediction: $180K Target in 2025 Despite Current Technical Pressures

#BTC

- Technical indicators show short-term bearish momentum with price below moving average and negative MACD

- Strong institutional sentiment with multiple $140K-$180K price predictions for 2025

- Growing corporate adoption offset by regulatory uncertainties and financial risk concerns

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support

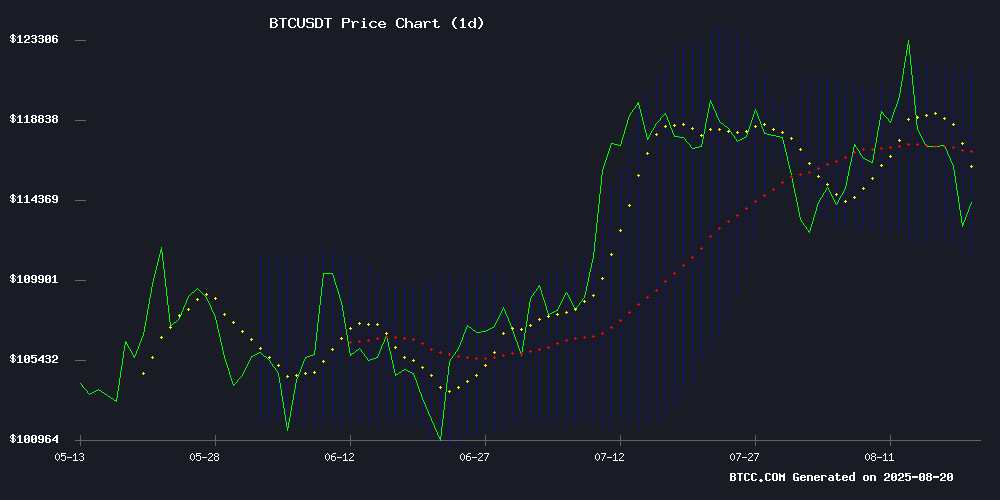

BTC is currently trading at $113,686, below its 20-day moving average of $116,473, indicating potential short-term weakness. The MACD reading of -1,041 suggests bearish momentum, though the Bollinger Bands show price hovering NEAR the lower band at $111,165, which could act as support. Analyst Emma notes that a break below this level might trigger further declines toward $105,000.

Market Sentiment: Institutional Optimism Contrasts with Technical Caution

Despite current technical weakness, news FLOW remains overwhelmingly positive. VanEck's $180K price target for 2025 and corporate adoption trends from companies like Cardone Capital and Lib Work suggest strong institutional demand. However, Emma cautions that regulatory uncertainties and MicroStrategy's scrutiny highlight ongoing risks that could temper near-term enthusiasm.

Factors Influencing BTC's Price

Will Bitcoin Price Hit $200K in 2025?

Bitcoin trades near $113,000 as institutional adoption enters a new phase, according to SkyBridge Capital founder Anthony Scaramucci. The supply-demand imbalance—only 450 new bitcoins mined daily—supports his firm's year-end target of $180,000-$200,000. "The math is clear," Scaramucci told CNBC, dismissing more speculative projections.

Investment avenues now span direct ownership, ETFs, and Bitcoin-linked equities like MicroStrategy. JPMorgan’s acceptance of Bitcoin as collateral underscores its mainstream credibility. SkyBridge maintains its bullish stance, citing structural scarcity and institutional inflows.

Jenny Johnson Highlights Key Investment Opportunities Beyond Bitcoin

Franklin Templeton CEO Jenny Johnson argues that the most compelling crypto investments lie not in Bitcoin but in the infrastructure enabling the sector. Speaking at the SALT conference in Wyoming, she framed blockchain's transformative potential as fundamentally rooted in its underlying systems rather than digital assets themselves.

While acknowledging Bitcoin's role as a hedge against economic instability, Johnson warned its prominence risks obscuring deeper structural shifts. "Bitcoin is one of the biggest distractions from the forthcoming major transformation in financial services," she stated, emphasizing blockchain networks and developer tools as higher-value long-term plays.

MicroStrategy's Bitcoin Strategy Under Scrutiny as Analyst Warns of Financial Risks

MicroStrategy's aggressive Bitcoin accumulation strategy faces mounting skepticism as analysts question its long-term sustainability. Independent market analyst Nick G. highlights concerning financial maneuvers, including share dilution and broken promises on equity issuance thresholds. "Saylor blatantly lied; no issuances below a certain value were to happen. Now trust is lost," the analyst states, comparing the company to a leaking investment fund.

The debate intensifies around corporate treasury purchases as a primary driver for Bitcoin's price stability. With MicroStrategy's $112,932 average Bitcoin purchase price under microscope, market observers warn that the company's potential collapse could trigger broader cryptocurrency bearish sentiment. Treasury strategies once seen as bullish catalysts now reveal structural vulnerabilities in crypto markets.

Cardone Capital Expands Bitcoin Strategy with 130 BTC Purchase in Miami Refinancing Deal

Cardone Capital has acquired 130 BTC as part of its Miami River project refinancing, marking the firm's fourth Bitcoin-linked real estate transaction. The move signals deepening institutional adoption of cryptocurrency as a hedge and value-creation tool in traditional asset portfolios.

The firm's planned $1 billion Bitcoin purchase has sparked market speculation about large-scale institutional crypto strategies. While maintaining a cautious stance for retail investors, Cardone Capital continues positioning itself at the forefront of real estate-crypto integration.

This transaction underscores a growing trend of digital asset adoption among property investment firms. Bitcoin's role as both an inflation hedge and strategic financial instrument is gaining recognition in traditionally conservative sectors.

Robert Kiyosaki Touts Bitcoin as the Simplest Path to Wealth

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' asserts that financial education and strategic investments—not mere accumulation of money—are the true drivers of wealth. His latest endorsement of Bitcoin as a 'set it and forget it' asset underscores its superiority over traditional avenues like real estate, which required far more effort for comparable returns.

Kiyosaki’s critique of financial illiteracy highlights a systemic failure in education. Professional athletes and lottery winners, despite windfall gains, often face bankruptcy without proper mentorship. His solution: align with wealthy mentors and prioritize assets like Bitcoin, which democratizes wealth-building.

Bitcoin Price Prediction for $140K–$150K Receives Peter Brandt’s Praise

Veteran trader Peter Brandt has endorsed a bold Bitcoin price forecast by analyst Colin Talks Crypto, calling the methodology "brilliant" and "outstanding." The projection, based on Tether's market dominance patterns, suggests BTC could reach $140,000–$150,000 by October 2025.

The Tether dominance chart has previously signaled major market tops, including Bitcoin's 2021 double peak and its recent rejection at $70,000. While creator Colin cautions it indicates cycle peaks rather than precise price targets, the model's track record has captured institutional attention.

Market liquidity and sentiment remain critical factors beyond Tether's metrics. Brandt's public support lends credibility to the technical approach, potentially influencing trader positioning ahead of the predicted rally window.

Franklin Templeton CEO Advocates for Crypto Infrastructure Over Bitcoin

Jenny Johnson, CEO of $1.6 trillion asset manager Franklin Templeton, argues that the true value in crypto lies not in Bitcoin but in the underlying infrastructure supporting digital assets. Speaking at the SALT conference in Jackson Hole, Wyoming, Johnson described Bitcoin as a "fear currency"—useful in unstable economies but ultimately a distraction from blockchain's transformative potential.

She emphasized investing in the "picks and shovels" of the industry: blockchain networks, validation systems, and consumer applications. "The rails are the starting point," Johnson said, highlighting validator roles and layered apps as key opportunities. Her stance reflects institutional focus on foundational technology rather than speculative assets.

Lib Work Adopts Bitcoin Treasury Strategy Amid Japan's Corporate Crypto Trend

Japanese 3D housing manufacturer Lib Work has unveiled a 500 million yen ($3.3 million) Bitcoin acquisition plan, scheduled between September and December 2025. The move positions the company among 289 global firms holding over 3.67 million BTC as inflation hedges and expansion capital.

Japan's corporate sector shows accelerating cryptocurrency adoption, fueled by favorable regulations and pending tax reforms. Lib Work's phased BTC accumulation strategy mirrors MicroStrategy's playbook, treating digital assets as superior treasury reserves compared to depreciating fiat holdings.

The Tokyo-based firm joins Japanese peers in reallocating cash reserves into Bitcoin, with corporate balancesheets now representing 17.5% of the cryptocurrency's circulating supply. Market analysts note such institutional accumulation creates structural supply constraints during bull markets.

Finance Industry Urges Regulators to Pause New Crypto Rules

Global financial trade associations are pushing for a delay in the implementation of stringent crypto banking rules slated for 2026. The rules, established in 2022 during a period of crypto market turmoil, are now seen as outdated and overly punitive. Banks argue that the high capital surcharges for holding unbacked digital assets like Bitcoin no longer align with the evolved market landscape.

The Basel Committee on Banking Supervision faces mounting pressure to recalibrate its approach. Institutional engagement with cryptocurrencies has grown significantly, and the current framework fails to reflect the maturity of digital ledger technology. A data-driven overhaul is essential to ensure proportional oversight without stifling innovation.

Major banks integrating crypto services highlight the urgency of balanced regulation. The 2022 rules risk creating unnecessary barriers as the sector moves toward mainstream adoption. Updated capital requirements must account for the dynamic nature of digital assets while safeguarding financial stability.

Royal Bank of Canada Expands Bitcoin Proxy Bet with $76M MicroStrategy Stake

Canada's largest bank has significantly increased its exposure to Bitcoin through a proxy investment. Royal Bank of Canada boosted its holdings in MicroStrategy by 16% last quarter, bringing its total position to $76 million as the business intelligence firm's shares rallied 32% to $404.

The move comes amid Bitcoin's impressive 30% quarterly surge, which saw the cryptocurrency briefly touch $111,980 before settling at $115,576. MicroStrategy, which holds over 214,000 BTC on its balance sheet, continues to serve as a preferred gateway for traditional finance institutions seeking crypto exposure without direct ownership.

RBC's growing position reflects broader institutional momentum toward Bitcoin-adjacent investments. Other major financial players are increasingly using similar strategies to gain indirect access to crypto's upside while navigating regulatory complexities.

VanEck Reaffirms $180K Bitcoin Price Target for 2025, Citing Institutional Demand

VanEck's latest ChainCheck report projects Bitcoin will hit $180,000 by December 2025, driven by unprecedented institutional accumulation. Nearly 300 entities now hold over 3.67 million BTC—MicroStrategy's aggressive treasury strategy exemplifying this trend.

The $54.97 billion influx into spot Bitcoin ETFs demonstrates Wall Street's growing conviction. Mining metrics reinforce the thesis: record-high difficulty levels and miner revenues coincide with 92% of on-chain holdings being profitable before the last ATH.

Is BTC a good investment?

Based on current analysis, BTC presents a compelling long-term investment despite near-term technical challenges. The convergence of institutional adoption, positive analyst projections, and growing corporate treasury strategies supports the bullish thesis. However, investors should be aware of the current technical weakness and regulatory risks.

| Metric | Current Value | Implication |

|---|---|---|

| Price | $113,686 | Below 20-day MA |

| 20-day MA | $116,473 | Resistance level |

| Bollinger Lower Band | $111,165 | Key support |

| Institutional Targets | $140K-$180K | Long-term bullish |